Artificial Intelligence and Next Generation Networks

1 Introduction

Mobile networks are continuously growing large; the average data consumption has increased multiple folds. 5G users in India are consuming around 3.6 times as much mobile data traffic compared to 4G since its launch in October 2022 [1]. The aspects regarding the service quality, network resiliency and security are becoming more and more important. 5G, has been the fastest-growing mobile technology but hasn't been as successful in deriving profits and revenue for operators. The overall industry has reached a growth plateau at least in multiple geographies. However, pressure on operational and organizational efficiencies to provide the differentiation shall remain high till industry discovers a differentiation use case for the mass.

The traditional form of network automation and optimization are no longer able to address the challenges of the modern networks effectively. Artificial intelligence and Machine learning are redefining the way network operations work and solving the complex problems where traditional methods are not sufficient or ineffective. Generative AI specifically (gen AI) could be the catalyst to reignite growth. Most of the major telco’s are already involved into pilots to limited deployments. However, question that remains is: “will it facilitate a groundbreaking differentiator or simply table stakes?”

In the subsequent sections we shall be sharing our perspective on this including the midterm impacts, current hurdles and how the long-term value can be created in the industry which is largely known for its traditional way of working. We shall touch upon briefly about the impact on the security landscape, integration challenges with other business verticals.

2 Focus Areas

Below are the major areas where GenAI in midterm can create value for the operators, these area’s primarily making the operations and development more efficient.

a) Operational cost Efficiency

Gen-AI can potentially make a strong impact in streamlining the network operations which majorly includes network components configuration management, bringing more automation into the fault management system and supporting it by more accurate prevention mechanisms. Network planning and inventory management operations can be optimized by maintaining relatively thinner inventory. Operational workforces’ productivity and accuracy can be upgraded as well.

b) Improved Customer Service

Customer service is of paramount focus for telcos. Gen-AI can enhance the customer services significantly by providing chat bots that can help the customers in self-service and/or issue resolution, in invoice creation, issue reporting, online KYC etc. A McKinsey report estimates that GenAI can increase the productivity of customer care functions by 30-45% mainly in the areas of Self-service, Quick resolution, shorter response time [2].

c) Reduction in Development Cost

Benefits in the software development will be similar to any other software-based industry. It shall be assisting in the code development, test case developments or helping engineers in upskilling in the ever-changing technical domains, making crisp reports from the evolving standard documents and regulatory documents.

d) Developing Business Insights

Generation of the sales leads from customer interactions and data is another useful area where telco’s sales teams can target the microsegments of the individual customers. These learnings can be useful and applied into other verticals as well where telco is involved.

3 Future Outlook

Extensive study of AI at 3GPP for the 5G advanced features, gives an idea how AI/ML are going to be the integral part of the inner skeleton of the network architecture, some of these features includes CSI feedback, beam management, and positioning which are crucial for the network operating at higher spectrum. Most of these developments are expected to be carried to early 6G specifications as well.

At O-RAN side as well standards around RAN Intelligent Controller and for O-Cloud are making the specifications and architectures around AI and ML more deployment ready. There is more clarity now regarding Data Exposure, Data Analytics, Life Cycle Management and Network Services.

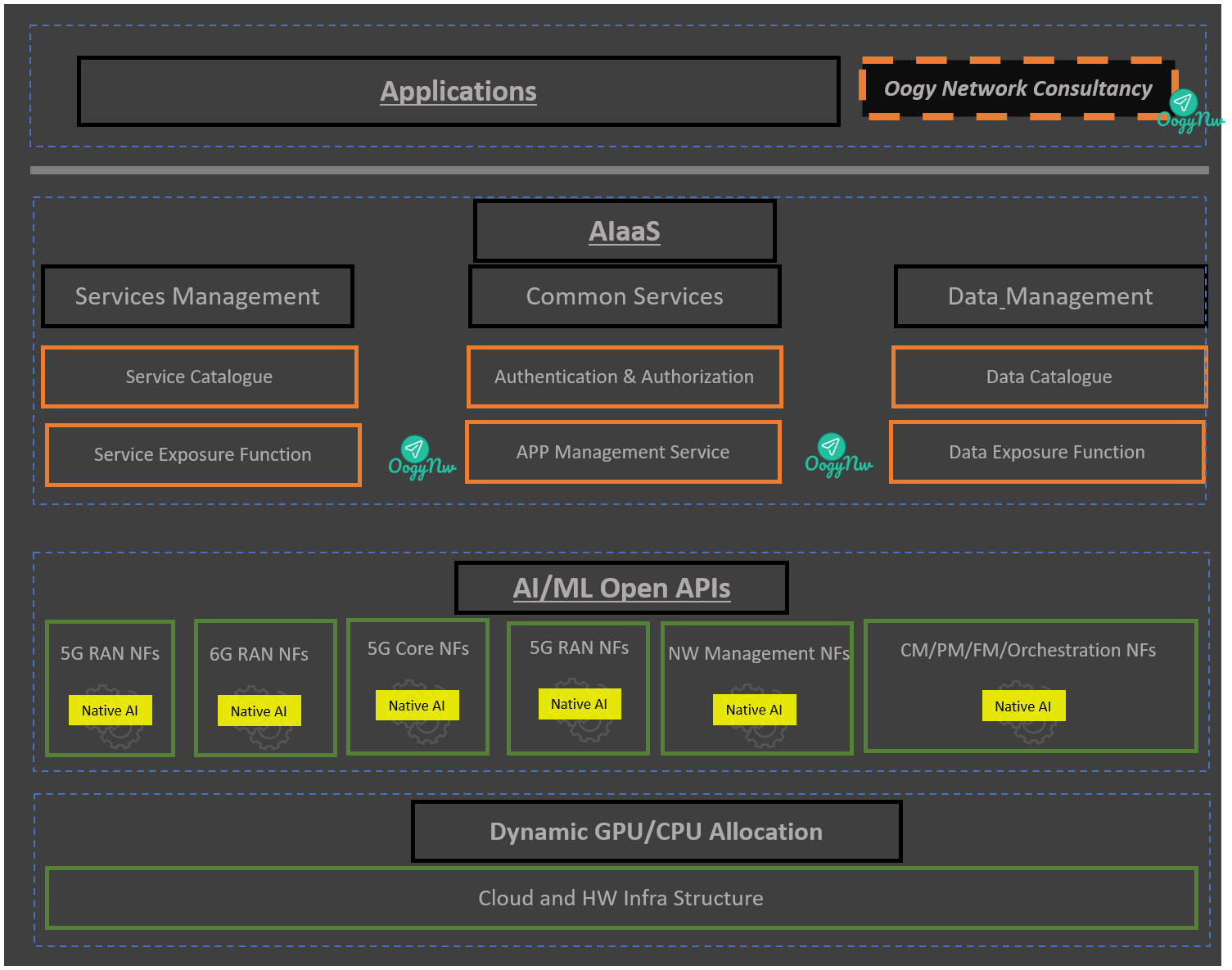

We mentioned above, briefly about the advancements in 3GPP RAN and O-RAN. however similar enhancements and native support for AI/ML functions are seen at other network components as well including Core Network, OSS/BSS and other network planning and management tools. It allows each component to expose AI/ML Apis internally as well as externally. Using these APIs from different native components of the network opens the pathway for more potent, scalable, and interoperable applications development with a much faster pace, which in true sense shall enable AI as a Service. The availability of Silicon supporting AI/ML Natively and with much lesser energy consumption shall be fueling the developments in this area much faster.

4 Model of Engagement

We see that there are broadly two models of engagement in the mid-term; one in which operator uses the available tools, say ‘Buyer Model’ and the other model in which operator uses some of the available tools, customizes it for its requirements, say ‘Hybrid Model’. Let us see in a little more detail about these two models, below:

a) Buyer Model: - As we discussed in the section 2, most of the midterm value creation for operators lies in making the organization more efficient in doing day to day work. This requires very little customization of the existing LLMS or other application for telecom specific requirements. This model may not create very big impact on the business. The operators would need to find the sweet spot to ensure return on investments (ROI) in midterm.

b) Hybrid Model: - This model requires more involvement from operators where operator customizes the available models based on its requirements and uses its private data to train it. Adoption of this model requires organizational changes, re-skilling and upskilling of the employees, changes in the data storage and availability mechanism. This essentially demands higher investments, but brings in competitor advantage owing to its potential to create insights for operators’ core businesses.

5 Apprehensions

Generative AI has created a positive vibe among service providers; however commercial interest remains low. While most are involved into testing and POC phase, a very small number of cases have seen the commercialization. Possible reason for this could be that even though there is a lot of noise around GenAI, operators would still need to figure out a) what real value can be created by GenAI for them as well as for their customers, b) how should early adapter shape their marketing campaigns, c) How much to be linked with GenAI (everything, most of the things?) d) Whether this technology can deliver the expected value to the customers?

Some of the leading operators have taken the initiatives to move towards GenAI; for example, “Ask AT&T” from AT&T helping coders and software developers across the company to become more productive, improving documentation and supporting employees in optimizing network, or in other words optimizing the way organization works [3]. Other use cases are also getting verified where by using this technology customer satisfaction is getting improved. Over all technology is getting matured and more efficient with the availability of the AI specialized silicon.

With all these welcome advancements, the puzzle that remains is - it doesn’t seem to be targeting the core business for the telco’s i.e., their network itself, so far. Things around it for sure provide some operational efficiencies and increase in employees’ productivity. However, these incremental gains need to be looked at from return-on-Investment perspective along with the internal plan of upskilling the employees. As a matter of fact, GenAI is not being able to establish the direct gains in the CapEx reduction or ARPU enhancements so far which adds to the operators’ apprehensions.

The recent news of data breach from AT&T has put everyone in a shock [4]; telco’s need the technology to help and ensure early identification and total prevention of any such events.

6 Conclusion

Operators have chosen different paths for their 5G journey; some had more focus on Standalone 5G deployment while some preferred non-stand-alone architecture, a few opted for more cloudification and ferberisation [PC2] while others chose to do so on need basis. Open-RAN added its own flavour in the diversification of the 5G deployment. The range of spectrum 5G supports is also very varied. From both technical and the business angles, selection of the engagement model is a tricky choice to make.

We at “Oogy Network Consultancy,” support our clients to do the technical and commercial evaluation of the available technologies as well doing the required customizations to help them achieve their short term as well as long term goals [5].